Good Morning ☀️

Hope everyone is having a great week. Checking in on this lovely Thursday, let’s begin…

What are we thinking about this week:

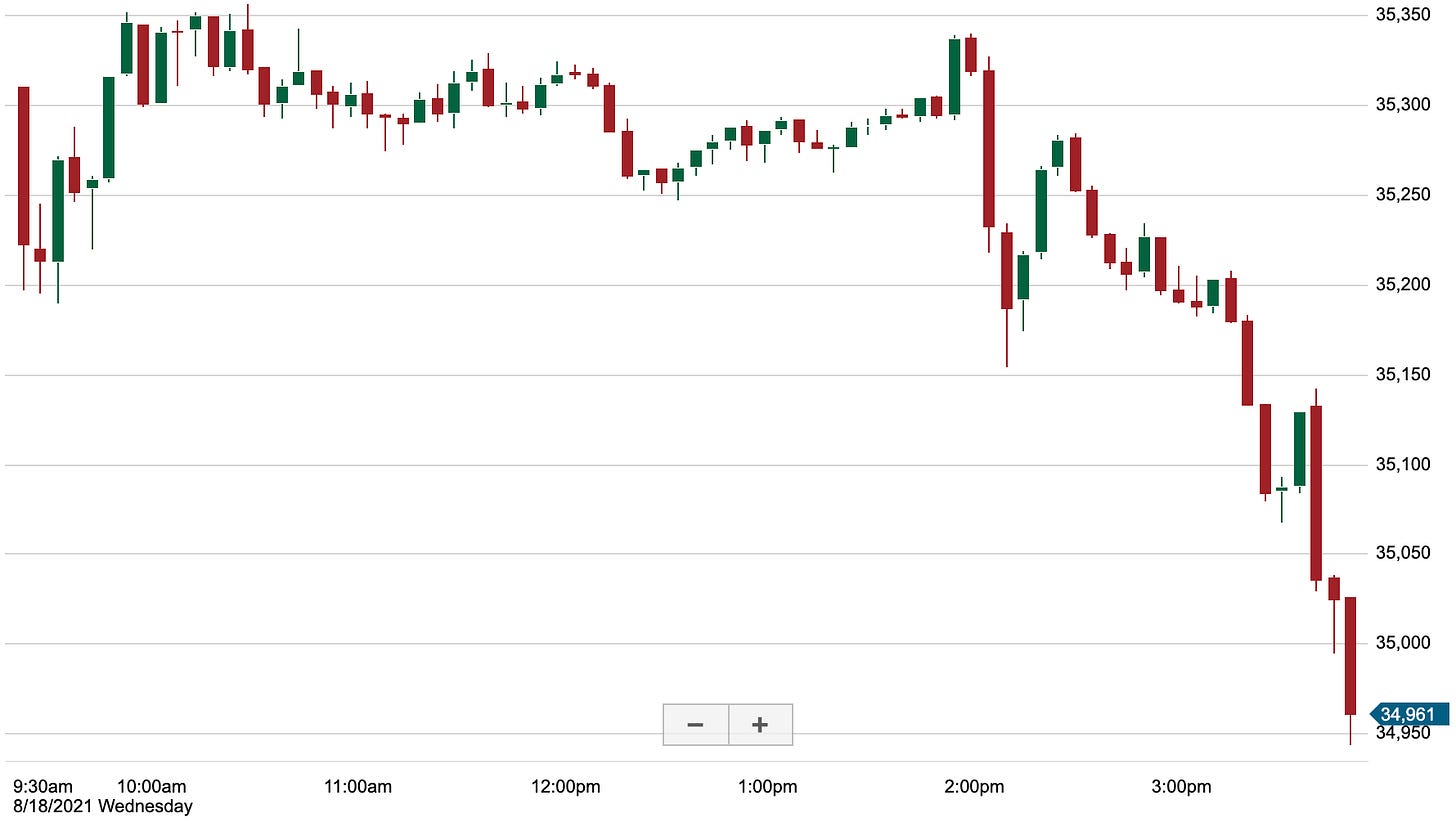

Tell me when the Fed hurt you…

That is one heck of a breakdown from yesterday. Apparently it’s December 2018 redux with the market pulling a tantrum over the Fed slowing, not ending, bond purchases. Today isn’t looking hot either, with S&P Futures down .57%. I may dip a toe in a SPY call option, looking for a rebound if the price action says so.

Retail sales dumped 1.1% from June to July, as economists expected a fall of 0.3%. Bright spot are people are eating and boozing, as those sales rose 1.7%. Online retail fell 3.1%. Maybe people are pinching pennies with going back to work, or Delta has shoppers scared (not if hospitality is up), or is everyone back in huge credit card debt so they had to stop shopping? LOW, HD, TGT, WMT all crushed earnings then got crushed due to the report sentiment.We’ll see what BBWI/VSCO (LB split), KSS, M, ROST have in store for their ERs today. (mostly beats except VSCO, which is good news for retail spending).

As a new BJ’s Wholesale member (ticker: BJ), I was disappointed when I walked in and realized that BJ’s is no Costco (COST). Quality of stuff/food is meh, stores aren’t as large and variety isn’t much. With that said, I’m intrigued with their ER (they beat, up 3% premarket).

Today’s jobless claims and continuing ones are still heading lower, which is great if people are getting jobs.

What we’re reading this week:

OnlyFans can’t find investors, just users… (Axios)… i’ll pony up my life’s worth to invest in it, sex sells, always has and always will.

Positive music leads to higher returns in this study… (JFE) - does mmmbop count even if i play it 20 years later?

Mike Burry from The Big Short is shorting ARK Innovation ETF… (WSJ) - how dare he, no one messes with my queen Cathy.

What makes a great investor? Apparently act like David Swensen. How do we find the next one… (Charles Korina) - i still have a shot. no i don’t.

What we traded last week:

WISH: I know, I pooped all over them, but at $6.70/share with their logistics and advertising revenues growing, why no?

SPY 8/27 $440p: Bought at $1.85 premium on 8/13, had a $2.50 stop, market came back on 8/16 so stopped out. Worth $5.15 at end of close on 8/18. One of these days, I’ll hold until the expiration. With today’s action lower, probably will hit $6.50, unless someone BTFD.

LYV: Stopped out at $79.90 after a 5% loss on 8/16. Proceeded to rise directly from that stop price to $81.xx. Oh well.

Added shares to PLTR. Sitting 15% cash.

Thanks for reading, please comment or ridicule us @OrchardTraders on Twitter.